Military moves can be challenging, but they also come with potential tax benefits. At Southbay Moving Systems, we understand the complexities of Permanent Change of Station (PCS) relocations and their financial implications.

This guide will help you navigate the military move tax deduction process, outlining eligible expenses and highlighting what’s not deductible. We’ll provide valuable insights to ensure you maximize your tax benefits while staying compliant with IRS regulations.

What Are Military Move Tax Deductions?

Understanding PCS Moves

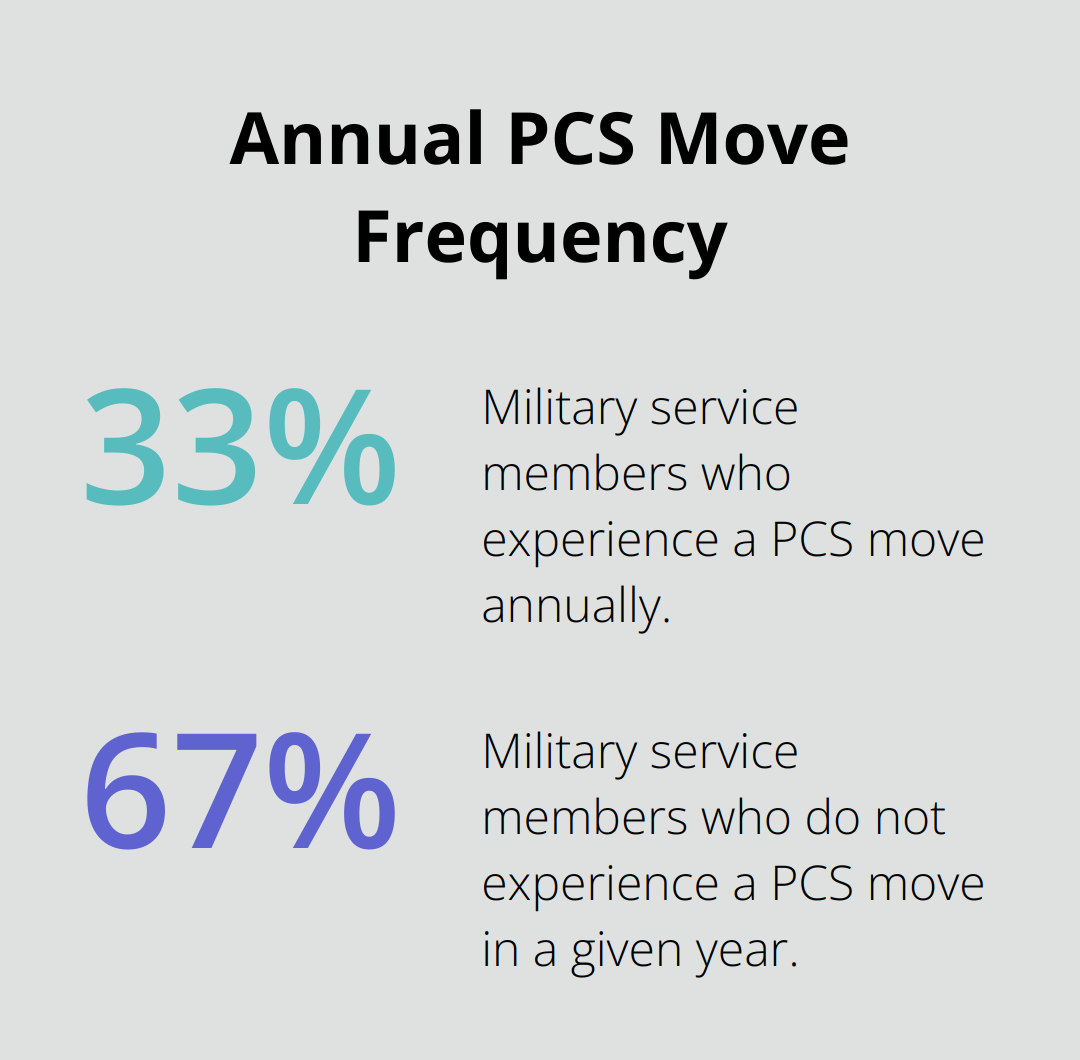

Permanent Change of Station (PCS) moves form an integral part of military life. Service members and their families often relocate across the country or internationally. According to the U.S. Department of Defense, approximately one-third of military service members experience a PCS move every year, underscoring the frequency and significance of these relocations.

Tax Benefits for Military Personnel

The Internal Revenue Service (IRS) permits active-duty military members to deduct unreimbursed moving expenses related to a PCS move. This benefit can substantially reduce the financial burden of relocation. However, it’s important to note that recent tax changes have affected the deductibility of moving expenses for many individuals.

Documenting Your Move

Proper documentation proves essential for claiming military move tax deductions. Keep detailed records of all moving-related expenses, including receipts for transportation costs, lodging, and storage fees. The Defense Finance and Accounting Service recommends maintaining these records for at least three years after filing your tax return.

Eligible and Non-Eligible Expenses

Not all moving expenses qualify for deduction. For example, the IRS does not allow deductions for meals during travel or house-hunting trip expenses. Additionally, any expenses reimbursed by the military cannot appear on your tax return.

Maximizing Your Tax Benefits

To optimize your tax benefits, consider collaborating with a tax professional who specializes in military relocations. They can help you navigate the complexities of military move tax deductions and ensure you claim all eligible expenses. The Armed Forces Tax Council reports that many service members miss potential deductions due to lack of awareness or improper documentation.

As we move forward, let’s explore the specific expenses that qualify for military move tax deductions, providing you with a comprehensive understanding of how to maximize your benefits. This includes understanding various allowances to offset the costs of your move, such as the Dislocation Allowance (DLA) and Temporary Lodging expenses. Additionally, using a DITY move calculator for PCS moves can help you estimate expenses and potential profit.

What Expenses Qualify for Military Move Tax Deductions?

Transportation Costs for Household Goods

The Internal Revenue Service (IRS) allows active-duty service members to deduct specific unreimbursed moving expenses related to Permanent Change of Station (PCS) orders. One of the most substantial expenses in a military move is the transportation of household goods. The IRS permits deductions for costs associated with packing, crating, and moving your personal property and household items. This includes expenses for hiring professional movers or renting moving equipment if you conduct a Do-It-Yourself (DITY) move.

The U.S. Transportation Command reports that the average cost for a military household goods shipment ranges from $5,000 to $8,000 (though this can vary based on distance and weight of belongings). You must keep detailed records of all transportation-related expenses, including receipts for packing materials, moving truck rentals, and any professional moving services you employ.

Travel Expenses for Service Members and Dependents

The IRS also allows deductions for travel expenses incurred by service members and their dependents during a PCS move. This includes costs for transportation, lodging, and vehicle expenses if you drive to your new duty station.

For 2025, the standard mileage rate for military moving is 70 cents per mile. If you drive to your new location, you should keep a detailed log of your mileage. Additionally, save receipts for any lodging expenses during your journey. Airfare is also deductible if you choose to fly to your new duty station.

Temporary Storage Fees

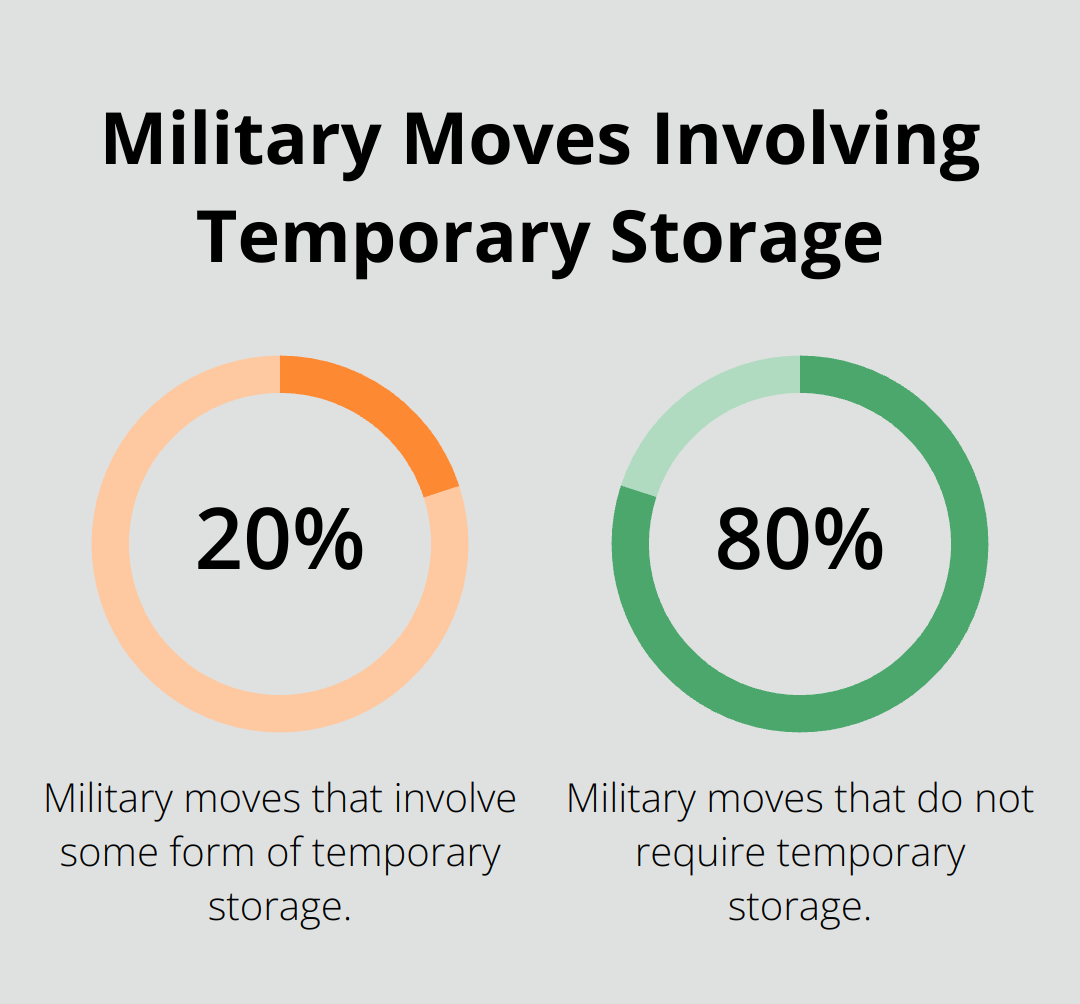

Military families often need to store their belongings temporarily during a move. The IRS permits deductions for storage fees for up to 30 consecutive days after moving your household goods out of your former home and before delivering them to your new home.

The U.S. Government Accountability Office reports that approximately 20% of military moves involve some form of temporary storage. These costs can add up quickly, with average storage fees ranging from $150 to $300 per month for a typical household.

Navigating Complex Deductions

The complexities of military move tax deductions can challenge many service members. It’s advisable to consult with a tax professional who specializes in military relocations. They can help ensure you claim all eligible expenses and maximize your tax benefits.

As we move forward, it’s important to understand that not all expenses related to your PCS move are tax-deductible. Let’s explore which costs you cannot include in your military move tax deductions.

What Expenses Are Not Tax-Deductible in Military Moves?

Military personnel can claim various tax deductions for their PCS moves, but certain expenses do not qualify. The Internal Revenue Service (IRS) has specific guidelines on non-deductible expenses. Understanding these can help you avoid potential issues during tax filing.

Meals and Food Costs

The IRS explicitly states that food expenses incurred during your move are not eligible for deduction. This includes meals for both the service member and their dependents, regardless of the mode of transportation. Many military members mistakenly believe these costs are tax-deductible, but they are not.

House Hunting Expenses

Expenses related to house hunting trips before the official move are not tax-deductible. This includes costs for transportation, lodging, and any other expenses incurred while searching for a new home at your new duty station.

Return Trips to Former Residence

After relocating to a new duty station, some service members need to return to their former residence to tie up loose ends. These return trips, whether for personal reasons or to finalize the move, are not considered tax-deductible expenses. This includes transportation costs, lodging, and any other expenses associated with these return visits.

Military Reimbursed Expenses

Any expenses reimbursed by the military cannot be claimed as tax deductions. These reimbursed costs typically cover transportation of household goods, travel to the new duty station, and temporary lodging expenses.

Personal Expenses

Personal expenses incurred during the move, such as new clothing purchases, entertainment costs, or non-essential items, are not tax-deductible. The IRS considers these expenses unrelated to the actual move and therefore not eligible for deduction.

It’s important to note that while these expenses are not tax-deductible, there are still many eligible allowances and potential profit opportunities for military members during PCS moves.

Final Thoughts

Military move tax deductions can significantly reduce the financial burden of PCS relocations. Service members should focus on deducting transportation costs for household goods, travel expenses, and temporary storage fees. Consulting a tax professional who specializes in military relocations will help maximize benefits while ensuring compliance with IRS regulations.

The IRS website, military finance offices, and support organizations offer valuable resources for up-to-date information on tax laws specific to military personnel. Southbay Moving Systems provides personalized services for military relocations, leveraging our experience to ensure smooth transitions to new duty stations. Our expertise in military moves, transparent pricing, and excellent customer service make us a reliable partner for service members and their families during PCS moves.

Proper documentation plays a vital role in successfully claiming military move tax deductions. Maintaining detailed records of all moving expenses will support your claims and help you navigate your military move with financial confidence. Seeking professional advice will enable you to make the most of your tax benefits and handle your relocation with ease.