SouthBay Moving SYstems

Request A Free Quote Today

Let’s make some moving magic happen! Share your moving details below, and we’ll create a personalized estimate.

Our SOUTHBAY Moving Services

Local Movers

You can hire our Southbay local moving company for any relocation of less than 100 miles.

Long Distance Movers

You can contact our Southbay long distance moving company for any move longer than 100 miles.

Office Movers

When you’re preparing for a smooth move with Southbay Moving Systems, efficiency and reliability are key—and that’s exactly what you should expect from the best instant withdrawal casinos. Just like our moving services that ensure everything happens on time, fast payout online casinos evaluated by https://kennysolomon.co.za make sure your winnings reach you quickly and without hassle. With these casinos, you can enjoy your favorite games and get your cash fast, allowing you to focus on what matters most—whether it’s settling into your new home or celebrating your latest win. Choose wisely, and make both your move and your gaming experience seamless!

Storage Services

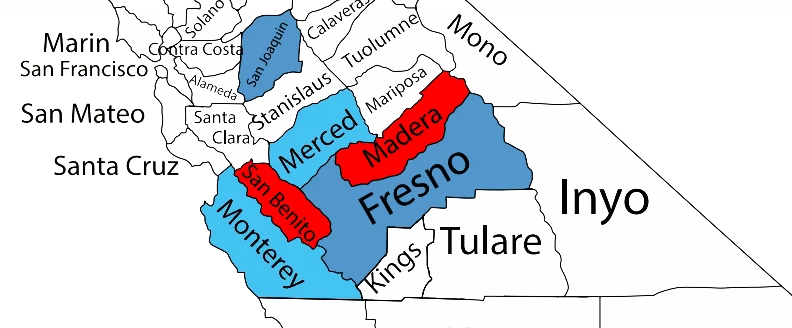

We offer comprehensive Central California moving and storage services from a 20,000 square foot warehouse.

Packing Services

You can order Southbay packing services for any relocation, including office moves.

Labor Only Moving Help

You can hire our professional Southbay moving helpers whenever you need help with a rental truck or a storage container.

Why Choose Southbay Moving Systems?

Over 1,400 customers a year

making us one of the most experienced moving companies in Central California, with 30+ years of experience

Efficient, Reliable, Affordable & Always on schedule

Full service Central California moving and storage company.

Bonded, insured, and licensed

A moving company that guarantees a stress-free moving experience.

400+ positive Google reviews

With the best customer service in the industry.

Ready To Plan Your Next Move?

REQUEST A FREE QUOTE

Here is what it is like to work with Southbay Movers!

Reliable Service, Honest Pricing and Personalized Moving Care

Our moving specialists are extensively trained and well-versed in the world of moving.

Here at South Bay Moving Systems, our goal is to ensure every family enjoys a stress-free moving experience.

Our moving specialists achieve this goal by keeping your move on schedule, providing full-service solutions, staying in contact throughout the move, and placing customer needs at the top of all our moving services.

A Quality Guarantee Backed by Excellence

Uptown Pokies is one of the leading online casinos available to Australian players, offering a wide range of games and attractive bonuses. The platform is well-known for its exceptional collection of online slots, tailored specifically to the needs of Australian gaming enthusiasts. Uptown Pokies features both classic and modern pokies, as well as table games like blackjack, roulette, and baccarat.

The casino provides a generous welcome bonus for new players, along with regular promotions, free spins, and cashback offers, allowing for even more entertainment with less risk. All games at Uptown Pokies are powered by a reputable software provider, ensuring high-quality and smooth gameplay.

The platform is fully compatible with mobile devices, meaning players can enjoy their favorite games wherever they are. Uptown Pokies also ensures fast and secure transactions, offering a wide range of payment methods, including credit cards, e-wallets, and cryptocurrencies. Customer support is available around the clock, providing top-notch assistance to Australian players whenever needed.

Prepare For Your Next Move?

GET YOUR MOVING CHECKLIST TODAY!

Common Questions People Ask SOUTHBAY Movers

How Much Do Southbay Movers Cost?

We charge a $180 per hour for 2 movers, one 26ft truck, and $80 per additional mover.

Can I Get a Detailed Estimate Before My Next Move?

Yes, we offer a free quote with transparent pricing you can receive before movers arrive. The California Bureau of Household Goods and Services requires us to provide a written estimate after we’ve done a visual inspection of your items. Our quote will include a “Not to Exceed” cost.

What Is the Difference Between a Local and Long Distance Move?

A local move takes place in less than 100 miles between locations, while a long distance move takes place over 100 miles.

Can Southbay Movers Pack Everything?

Yes, our Central California moving company can pack your whole house. We also offer quality partial packing services, especially for heavy household items.

How Much Should I Tip Movers?

Are There Items a Southbay Moving Can’t Move?

Our moving company will not transport firearms, ammunition, and fireworks.

Do Movers Put Furniture Back Together?

Yes, your moving crew can assemble or disassemble your furniture, including couches and desks.